Mortgage Contingency Review

I’ll warn you upfront, this is going to be a dry topic. This is a review of the Mortgage Contingency paragraph in the Standard Agreement for the Sale of Real Estate. More specifically, this is a refresher on the interest rates and discounts that should be entered in this contingency.

Money was very cheap for so long that we, as REALTORS®, did not have to be particularly mindful of the terms in the mortgage contingency. Interest rates were low and steady for years, but that’s now changed. Now we have to consider the risk of rates increasing between the time the offer is submitted and when the offer is accepted. Until there is a fully executed agreement, the buyer’s interest rate is not locked in. Is the buyer qualified to make this purchase up to the maximum interest rate you’ve entered in paragraph 8(A)?

What rates are you using for the interest rate vs. maximum rate in this paragraph? Are you allowing for any fluctuation in rate? These terms are important from the seller’s point of view when evaluating the strength of the buyer. If the maximum rate is lower than the typical going rate, then the seller may assume the buyer is not qualified for more and not very strong financially. Additionally, make sure the lender has approved the buyer for the maximum rate you have entered.

The next blank in this paragraph is the percent for discount points, loan origination, loan placement and other fees charged by the lender as a percentage of the mortgage loan. Points are back as buyers are trying to lock in as low of a rate as they can. If your buyer’s rate is conditioned on paying points, you should enter this percentage in paragraph 8(A).

Second mortgages are also back. If the buyer is financing 80%LTV with a 20%LTV second mortgage to avoid mortgage insurance, the second mortgage terms should be entered in 8(A).

Listing agents should communicate with buyers’ agents and lenders to fully understand the financing outlined in the Agreement so that the seller can accurately understand the buyer’s mortgage terms and qualifications.

For your reference, here is paragraph 8(A):

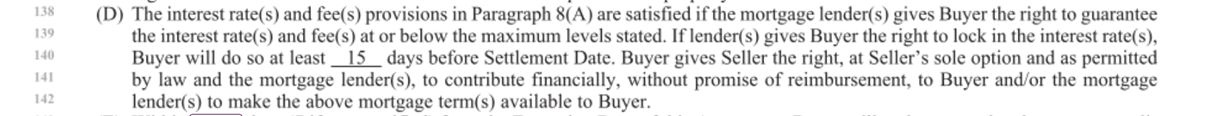

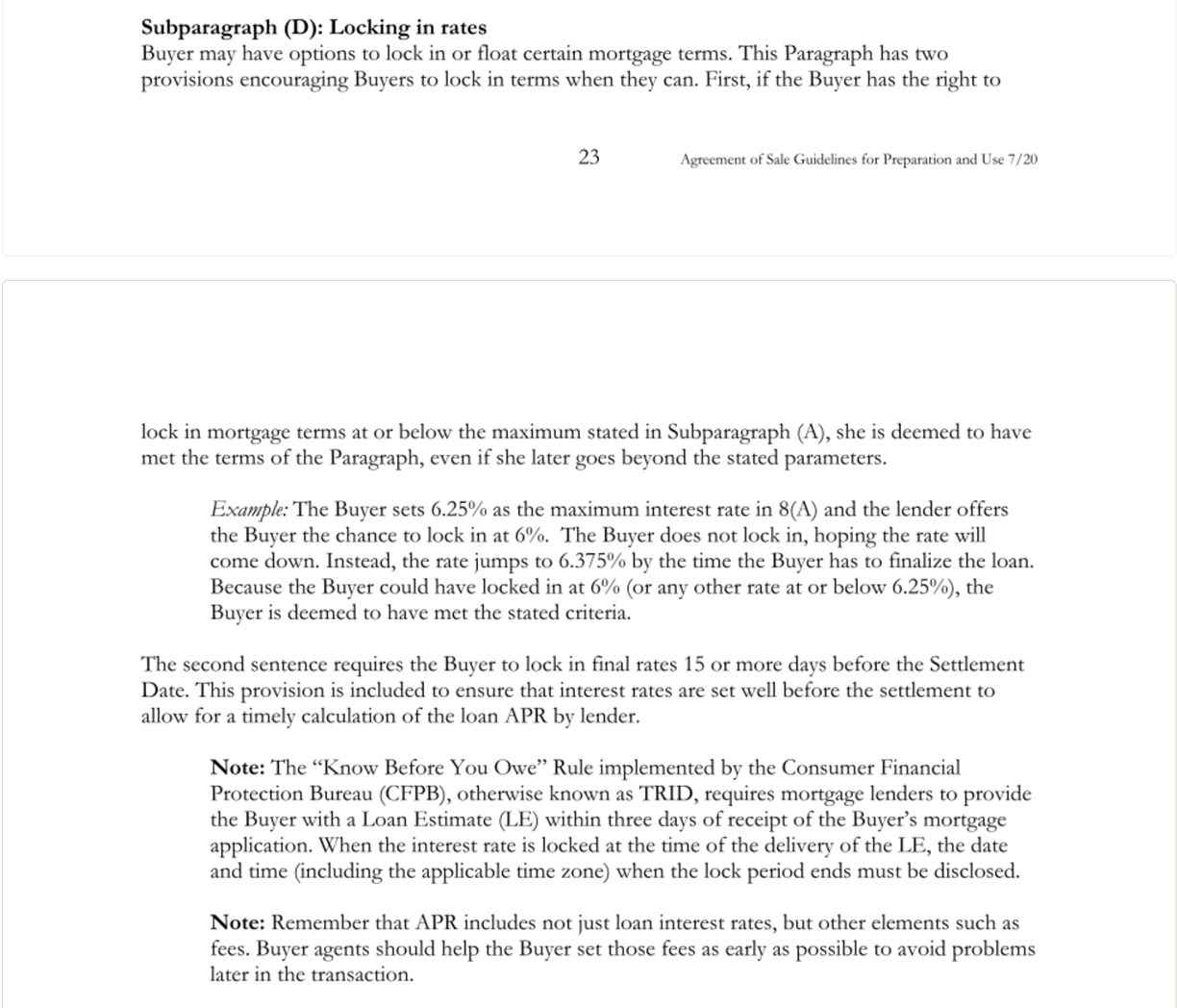

Paragraph 8 Subparagraph D relates back to the interest rates stated in 8(A). In this paragraph, the terms of 8(A) are satisfied if the maximum interest rate was offered by the lender, even if the Buyer chooses to float and the rate goes up and exceeds the maximum rate. The Buyer must lock at least 15 days before settlement (unless this number has been modified). Lastly, the Buyer gives the Seller the right to contribute financially to make the mortgage terms work for the Buyer. In other words, if the interest rate offered by the lender exceeds the Buyers maximum amount stated, the Seller can contribute financially to bring the terms back to what is stated. For example, the Seller can pay points (as permitted by the lender) on behalf of the buyer to reduce the interest rate to the maximum amount stated.

For your reference, here is Subparagraph (D):

If you still have some stamina to review more details about the Mortgage Contingency paragraph, take a deeper look at what is written in the Standard Agreement for the Sale of Real Estate Guidelines for Preparation & Use prepared by the Pennsylvania Association of Realtors®:

Here are the guidelines for 8(A):

Here are the guidelines for Subparagraph (D):